Catch-up Bookkeeping Ottawa

Books Up-to-Date. Business On Track.

Falling behind on bookkeeping can be stressful, especially with tax deadlines approaching. At HAT Accounting, our expert Ottawa bookkeepers bring your financial records up to date efficiently, so you regain control and peace of mind.

The HAT Advantage

Get Your Books Up to Date, Fast and Stress-Free

Expert Bookkeepers

Our team quickly brings your books up to date with proven workflows, accurate reconciliations, and secure cloud storage.

Funding Clarity

Get an updated income statement and balance sheet to apply for loans or pitch to investors with confidence.

Tax-Ready Financials

Once your books are current and fully compliant, you’ll have everything needed to work with your accountant for tax season.

Transparent Pricing

We assess your needs upfront, keep you informed, and ensure no hidden fees, just clear, reliable pricing.

Our Catch-Up Bookkeeping Services Include

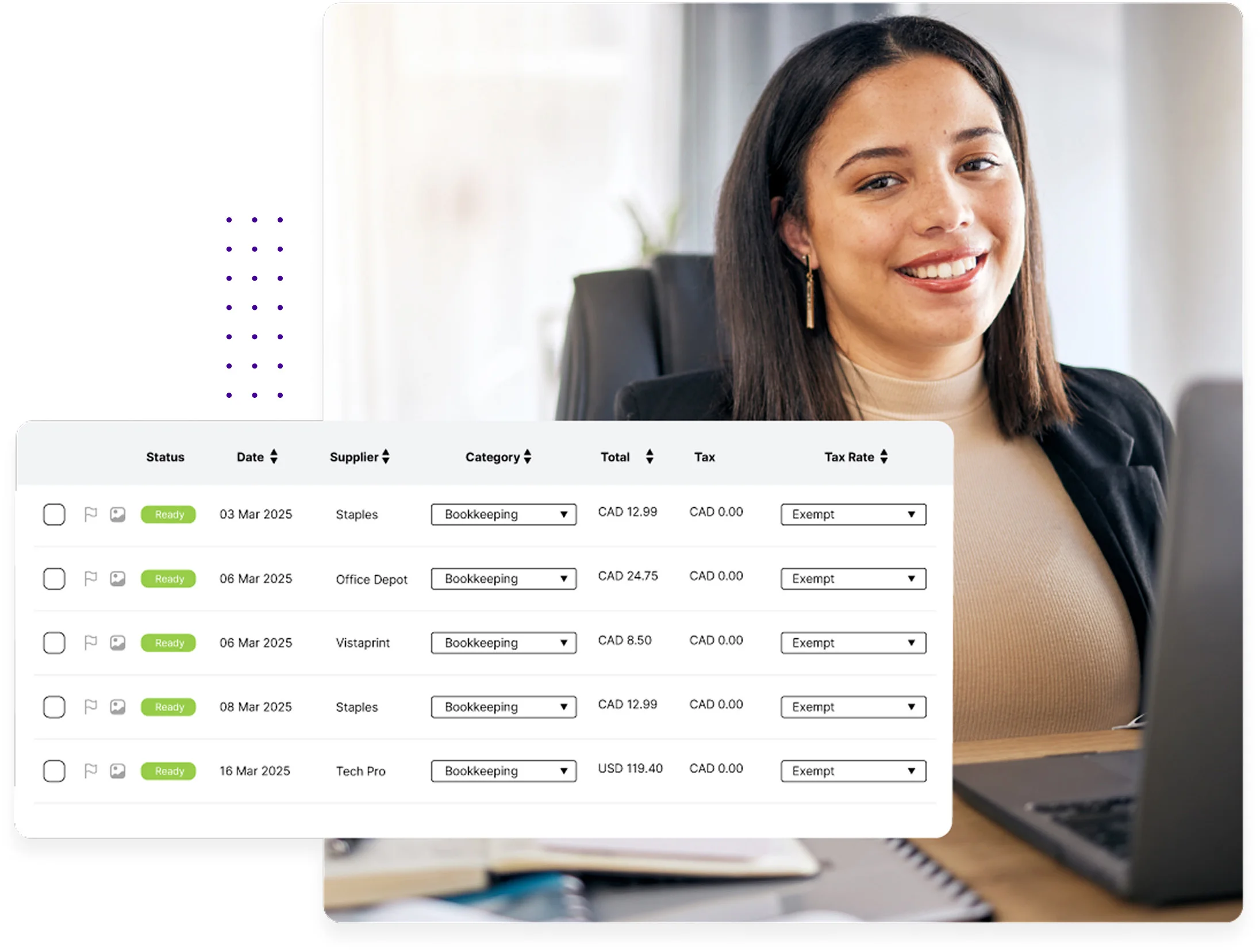

- Recording missing or misclassified transactions

- Bank and credit card reconciliations

- Creation of up-to-date financial statements

- Complete tax-ready financial reports

- Secure digital storage for receipts and documents

- Ongoing support from your dedicated Ottawa accountant

Our Approach

How We Get Your Books Back on Track

We take a four-step approach to delivering the best catch-up bookkeeping and accounting support for Ottawa businesses.

Understand

We review your business and understand how far behind your books are, identifying key priorities.

Design

We create a custom bookkeeping workflow using the best tools for your business, ensuring seamless integration.

Implement

Our team cleans up your books, rectifies errors, and trains your staff on best practices.

Manage

We handle your bookkeeping and tax preparation, keeping finances current and compliant

What Our clients are saying.

We work with you to fully understand your business needs and support requirements.

Their Big 4 background really shows. They understand fitness industry cash flow and membership revenue perfectly. Set up our books properly and now I actually understand my financials. Game changer for my gym.

Anytime Fitness - Tyler S.

As a company providing fully managed IT and software services, we have a lot to juggle. HAT Accounting has provided us clear organization of our complex revenue streams and helped us track profitability by service line. Their monthly reports show us exactly where to focus our growth efforts.

WebFoundr - Haider A.

Real estate has so many moving pieces - commission splits, escrow, 1099s. These guys handle it all perfectly. Their systems actually work for how we operate.

Avenue North Realty - Asem M.

Running a Shopify e-commerce store means tracking inventory, sales tax, shipping costs, and ad spend across multiple platforms. Hat organized our messy books and now we get clear monthly reports showing actual profit showing us the winners and products draining cash.

E-Commerce Store - Edris M.

End-to-End Financial Support for Your Business

Whether you’re behind on your books or ready to scale your financial operations, HAT Accounting provides complete support all under one roof.

Monthly Bookkeeping

Keep your business compliant with accurate, updated financials handled by professionals.

Catch-Up Bookkeeping

Behind on bookkeeping? We’ll reconcile, correct, and organize everything efficiently.

Payroll

Ensure every pay run is accurate, compliant, and stress-free.

Accounts Payable

Simplify bill payments, vendor management, and expense tracking.

CFO

Gain financial oversight and growth strategy from experienced experts.

Fractional Controllership

Gain financial oversight and strategic support from experienced professionals.

FAQs

We specialize in helping Canadian Not-for-Profits and Businesses with their financial operations.

I have multiple years of catch up. Can you help?

Yes! There is no limit on how far back we can go.

What do you need to get my catch-up bookkeeping done?

It depends, but we will need your last set of year end financial statements from your CPA (if any) and your last tax return filed (if ever filed). We will also need bank and credit card statements for the relevant catch-up periods along with receipts that you have to support business transactions.

Do you offer catch-up bookkeeping services only?

We only offer catch-up bookkeeping services to clients that we are onboarding for ongoing monthly services.

Do I need separate business bank and credit card accounts for bookkeeping?

Yes, for ongoing bookkeeping services it is important to have dedicated business bank and credit card accounts. This helps keep your financial records organized and ensures accurate reporting. However, if you have previously used personal accounts for business transactions, we can still help. Our catch-up bookkeeping services are designed to sort through mixed transactions and get your books up to date.

Which bookkeeping software do you use?

Quickbooks Online and Xero are the only platforms we work with.